What are the steps to become a day trader in the cryptocurrency market?

Can you provide a step-by-step guide on how to become a day trader in the cryptocurrency market? I'm interested in learning the necessary skills and strategies to start trading cryptocurrencies on a daily basis.

3 answers

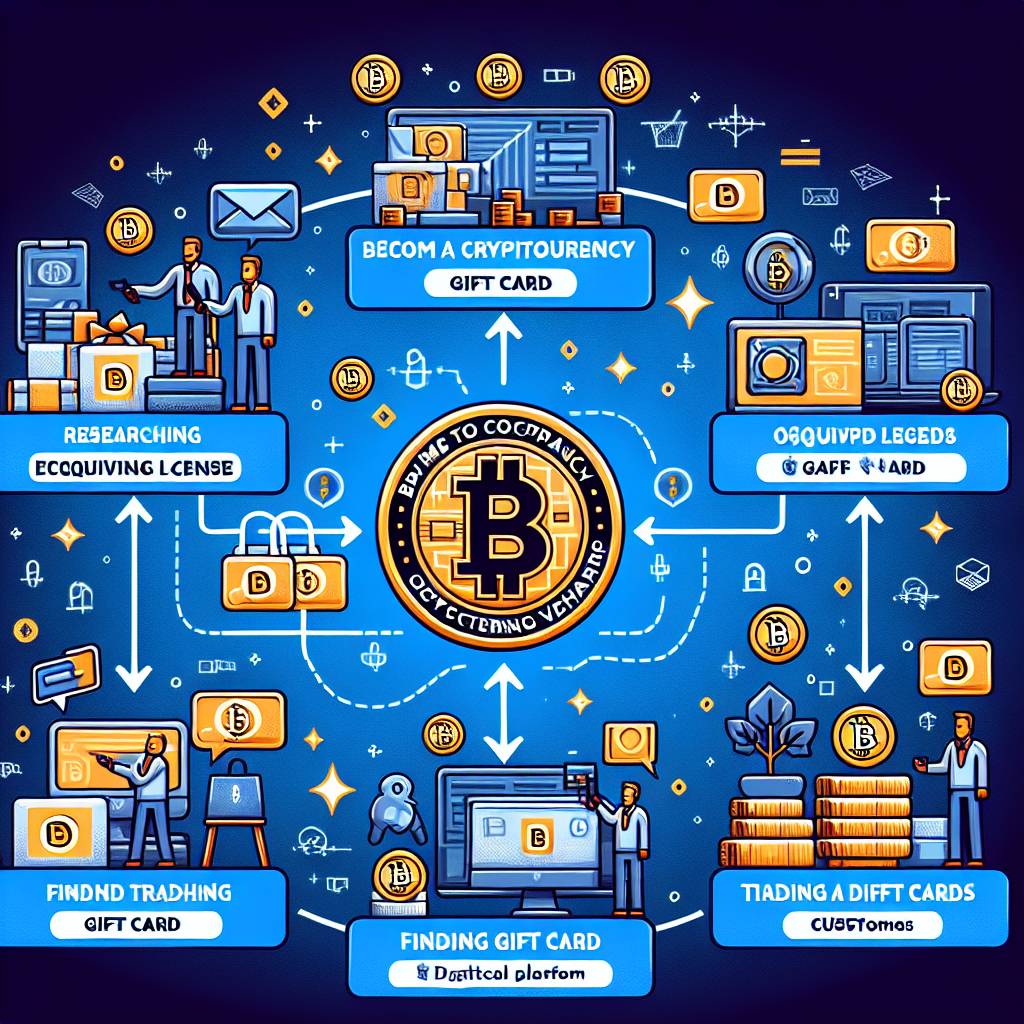

- Becoming a day trader in the cryptocurrency market requires a combination of knowledge, skills, and experience. Here are the steps you can follow: 1. Educate yourself: Start by learning the basics of cryptocurrencies, blockchain technology, and how the cryptocurrency market works. Understand different trading strategies and technical analysis tools. 2. Choose a reliable exchange: Select a reputable cryptocurrency exchange that offers a wide range of cryptocurrencies and has a user-friendly interface. Ensure the exchange has good security measures in place. 3. Create a trading plan: Develop a trading plan that includes your goals, risk tolerance, and trading strategies. Stick to your plan and avoid emotional decision-making. 4. Practice with a demo account: Before risking real money, practice trading with a demo account. This will help you familiarize yourself with the trading platform and test your strategies without any financial risk. 5. Start small: Begin with a small amount of capital and gradually increase your investments as you gain experience and confidence. 6. Stay updated: Stay informed about the latest news and developments in the cryptocurrency market. Follow reputable sources and join online communities to learn from experienced traders. 7. Manage risk: Implement risk management techniques such as setting stop-loss orders and diversifying your portfolio. Never invest more than you can afford to lose. Remember, becoming a successful day trader takes time, practice, and continuous learning. It's important to stay disciplined and not let emotions dictate your trading decisions.

Dec 16, 2021 · 3 years ago

Dec 16, 2021 · 3 years ago - Becoming a day trader in the cryptocurrency market is not an easy task. It requires a deep understanding of the market, technical analysis, and risk management. Here are the steps you can take: 1. Learn about cryptocurrencies: Start by educating yourself about different cryptocurrencies, their underlying technology, and their potential use cases. Understand the factors that influence cryptocurrency prices. 2. Choose a reliable exchange: Select a reputable cryptocurrency exchange that offers a wide range of cryptocurrencies and has a user-friendly interface. Look for exchanges with high liquidity and good security measures. 3. Develop a trading strategy: Create a trading strategy that suits your risk tolerance and investment goals. Consider factors such as entry and exit points, stop-loss orders, and profit targets. 4. Start with a small investment: Begin by investing a small amount of money that you can afford to lose. This will allow you to gain experience and learn from your mistakes without risking too much. 5. Practice with a demo account: Many exchanges offer demo accounts where you can practice trading with virtual money. Use this opportunity to test your trading strategy and familiarize yourself with the trading platform. 6. Stay updated with market news: Keep yourself informed about the latest news and developments in the cryptocurrency market. Follow influential traders and analysts on social media and join cryptocurrency forums to stay connected. 7. Manage your risks: Set a stop-loss order for each trade to limit your losses. Diversify your portfolio by investing in different cryptocurrencies to spread the risk. Remember, day trading is a high-risk activity and not suitable for everyone. It requires discipline, patience, and continuous learning. Only invest what you can afford to lose.

Dec 16, 2021 · 3 years ago

Dec 16, 2021 · 3 years ago - To become a day trader in the cryptocurrency market, follow these steps: 1. Learn about cryptocurrencies: Start by understanding the basics of cryptocurrencies, blockchain technology, and how the cryptocurrency market operates. 2. Choose a reliable exchange: Select a reputable cryptocurrency exchange that offers a wide range of cryptocurrencies and has a user-friendly interface. Look for exchanges with good security measures. 3. Develop a trading strategy: Create a trading strategy that aligns with your risk tolerance and investment goals. Consider factors such as technical analysis, market trends, and risk management. 4. Start with a small investment: Begin by investing a small amount of money that you can afford to lose. This will allow you to gain experience and learn from your mistakes without risking too much. 5. Practice with a demo account: Many exchanges offer demo accounts where you can practice trading with virtual money. Use this opportunity to test your trading strategies and familiarize yourself with the trading platform. 6. Stay updated with market news: Keep yourself informed about the latest news and developments in the cryptocurrency market. Follow influential traders and analysts on social media and join cryptocurrency communities to stay updated. 7. Monitor and analyze your trades: Keep track of your trades and analyze your performance. Identify patterns and adjust your strategies accordingly. Remember, day trading is a highly volatile and risky activity. It requires discipline, patience, and continuous learning. Only invest what you can afford to lose.

Dec 16, 2021 · 3 years ago

Dec 16, 2021 · 3 years ago

Related Tags

Hot Questions

- 94

What are the tax implications of using cryptocurrency?

- 93

Are there any special tax rules for crypto investors?

- 78

What are the best digital currencies to invest in right now?

- 77

How can I minimize my tax liability when dealing with cryptocurrencies?

- 73

What are the advantages of using cryptocurrency for online transactions?

- 63

What is the future of blockchain technology?

- 43

How can I protect my digital assets from hackers?

- 38

What are the best practices for reporting cryptocurrency on my taxes?