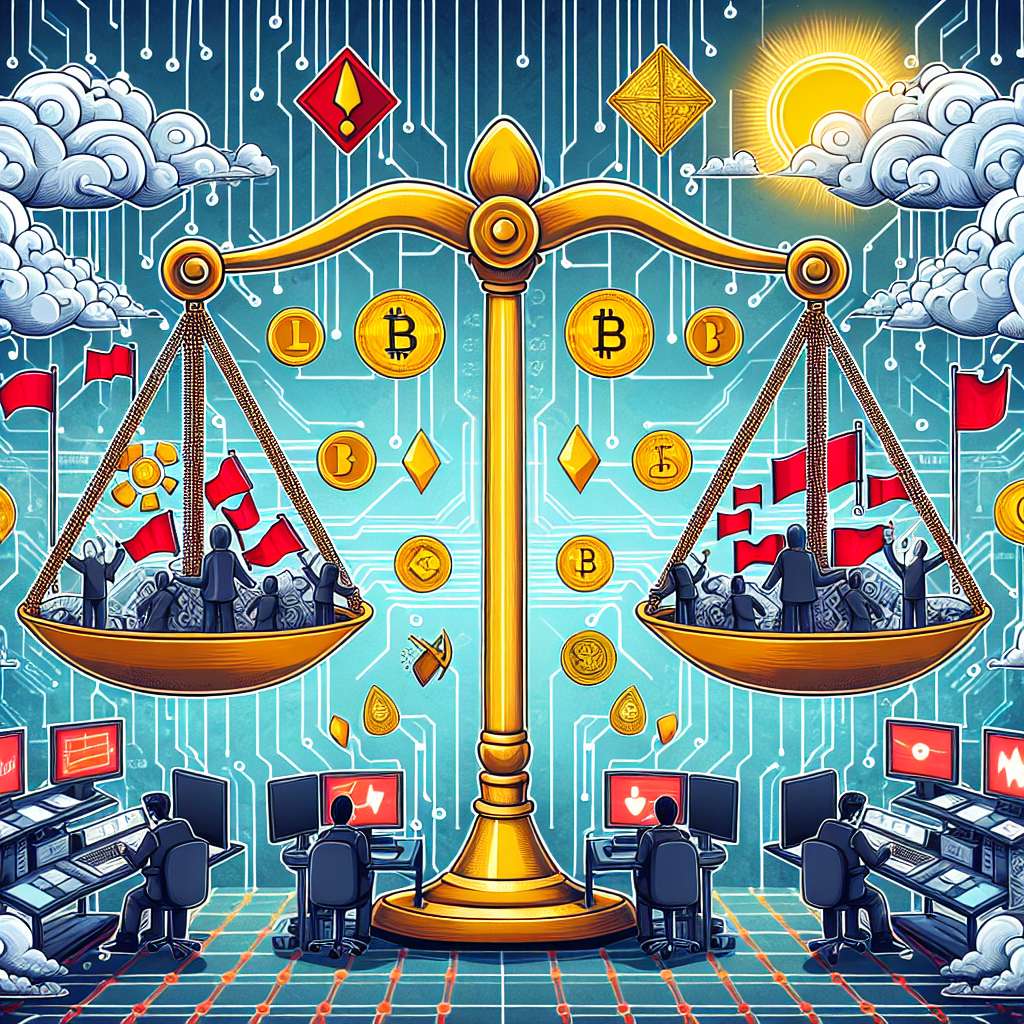

What are the risks and rewards of expert option trading in the cryptocurrency market?

What are the potential risks and rewards that come with engaging in expert option trading in the cryptocurrency market? How can one navigate these risks and maximize the potential rewards?

6 answers

- Expert option trading in the cryptocurrency market can be both risky and rewarding. On the risk side, the volatile nature of cryptocurrencies can lead to significant price fluctuations, potentially resulting in substantial losses. Additionally, the lack of regulation in the cryptocurrency market can expose traders to scams and fraudulent activities. However, the potential rewards of expert option trading can be enticing. With proper knowledge and analysis, traders can take advantage of the market's volatility to make substantial profits. It is important to approach option trading in the cryptocurrency market with caution and to thoroughly research and understand the risks involved before making any investment decisions.

Dec 15, 2021 · 3 years ago

Dec 15, 2021 · 3 years ago - When it comes to expert option trading in the cryptocurrency market, the risks and rewards go hand in hand. The high volatility of cryptocurrencies can lead to significant gains, but it can also result in substantial losses. It is crucial for traders to have a deep understanding of the market and to stay updated on the latest trends and news. By carefully analyzing market conditions and using effective risk management strategies, traders can mitigate the risks and increase their chances of reaping the rewards. It is important to remember that option trading in the cryptocurrency market requires expertise and should not be taken lightly.

Dec 15, 2021 · 3 years ago

Dec 15, 2021 · 3 years ago - Expert option trading in the cryptocurrency market can be a lucrative opportunity for those who have the necessary skills and knowledge. However, it is important to approach it with caution. BYDFi, a leading cryptocurrency exchange, offers a range of options for traders looking to engage in expert option trading. With a user-friendly interface and advanced trading tools, BYDFi provides a platform for traders to navigate the risks and maximize their potential rewards. Traders can take advantage of BYDFi's robust security measures and extensive market analysis to make informed trading decisions. It is important to remember that option trading in the cryptocurrency market carries inherent risks and traders should only invest what they can afford to lose.

Dec 15, 2021 · 3 years ago

Dec 15, 2021 · 3 years ago - Expert option trading in the cryptocurrency market can be a risky endeavor, but the potential rewards can be substantial. Traders need to be aware of the risks associated with this type of trading, such as market volatility and the potential for loss. However, with proper risk management strategies and a deep understanding of the market, traders can minimize their risks and increase their chances of success. It is important to stay informed about the latest market trends and to continuously educate oneself about the intricacies of option trading in the cryptocurrency market. By doing so, traders can position themselves for potential rewards while managing the associated risks.

Dec 15, 2021 · 3 years ago

Dec 15, 2021 · 3 years ago - Option trading in the cryptocurrency market offers both risks and rewards. The risks include the high volatility of cryptocurrencies, which can lead to significant price fluctuations and potential losses. Additionally, the lack of regulation in the cryptocurrency market can expose traders to scams and fraudulent activities. On the other hand, the potential rewards of option trading can be substantial. With proper analysis and risk management, traders can take advantage of the market's volatility to make profitable trades. It is important for traders to stay updated on market trends and to continuously improve their trading strategies to maximize their potential rewards.

Dec 15, 2021 · 3 years ago

Dec 15, 2021 · 3 years ago - Engaging in expert option trading in the cryptocurrency market involves both risks and rewards. The risks include the potential for significant losses due to the volatile nature of cryptocurrencies and the lack of regulation in the market. However, the rewards can be substantial for those who are able to navigate the risks effectively. By staying informed about market trends, conducting thorough research, and using proper risk management strategies, traders can increase their chances of success. It is important to approach option trading in the cryptocurrency market with a realistic mindset and to only invest what one can afford to lose.

Dec 15, 2021 · 3 years ago

Dec 15, 2021 · 3 years ago

Related Tags

Hot Questions

- 83

How can I buy Bitcoin with a credit card?

- 81

How can I minimize my tax liability when dealing with cryptocurrencies?

- 74

How can I protect my digital assets from hackers?

- 66

How does cryptocurrency affect my tax return?

- 58

What are the best practices for reporting cryptocurrency on my taxes?

- 58

What are the best digital currencies to invest in right now?

- 55

Are there any special tax rules for crypto investors?

- 47

What is the future of blockchain technology?