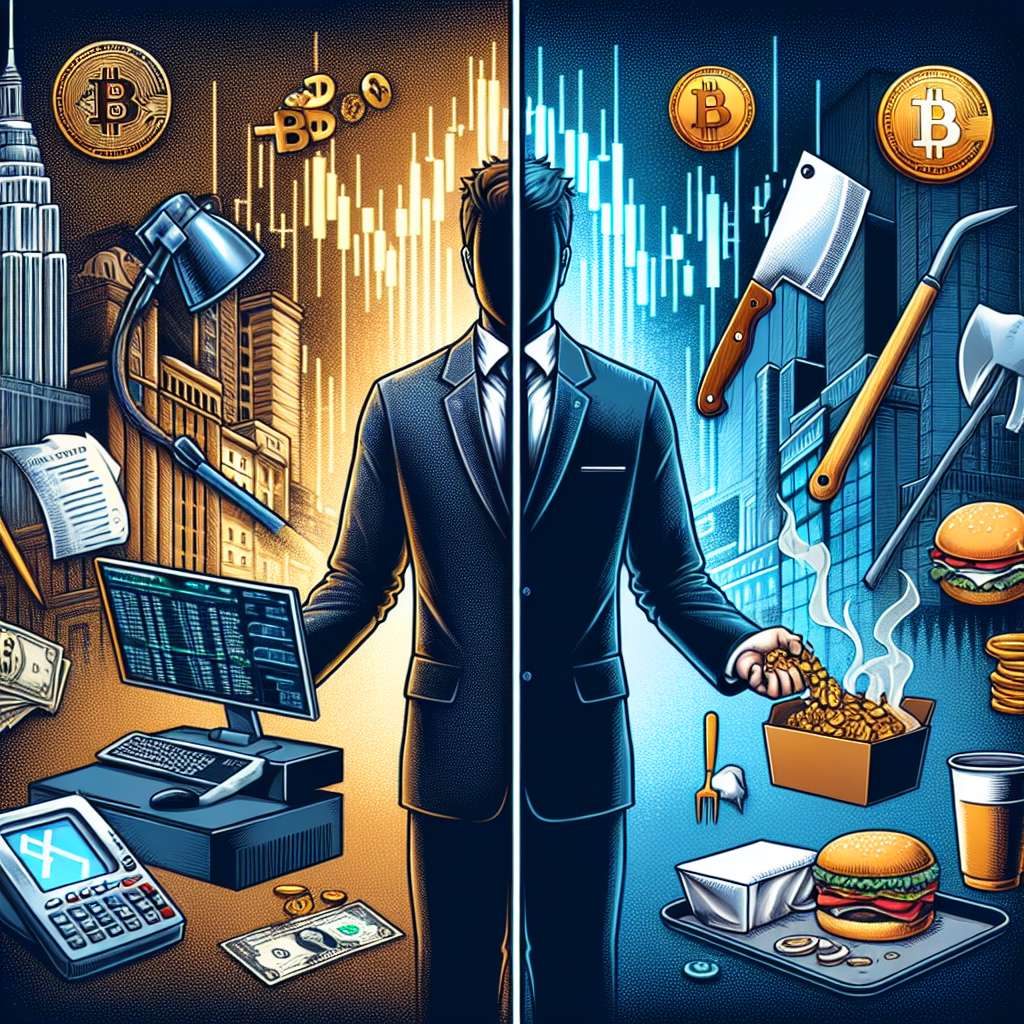

What are the risks and rewards of choosing cryptocurrencies over a Roth IRA or 401k?

What are the potential risks and rewards associated with investing in cryptocurrencies instead of a Roth IRA or 401k retirement account?

5 answers

- Investing in cryptocurrencies can offer high potential rewards, but it also comes with significant risks. The main reward is the potential for substantial returns on investment. Cryptocurrencies have experienced significant price increases in the past, and some investors have made huge profits. However, it's important to note that the cryptocurrency market is highly volatile and unpredictable. This means that while there is potential for high returns, there is also a high risk of losing your investment. Additionally, cryptocurrencies are not regulated by any government or financial institution, which means there is a lack of investor protection. It's crucial to thoroughly research and understand the risks involved before investing in cryptocurrencies.

Dec 18, 2021 · 3 years ago

Dec 18, 2021 · 3 years ago - Choosing cryptocurrencies over a Roth IRA or 401k can be a risky decision. While cryptocurrencies have the potential for high returns, they are also highly volatile and can experience significant price fluctuations. Unlike a Roth IRA or 401k, which are retirement accounts designed for long-term investment and offer tax advantages, cryptocurrencies do not provide the same level of stability and security. Additionally, cryptocurrencies are still relatively new and their long-term viability is uncertain. It's important to carefully consider your risk tolerance and investment goals before deciding to invest in cryptocurrencies.

Dec 18, 2021 · 3 years ago

Dec 18, 2021 · 3 years ago - Investing in cryptocurrencies instead of a Roth IRA or 401k can be an exciting opportunity for diversification. While traditional retirement accounts offer a more stable and predictable investment option, cryptocurrencies can provide the potential for higher returns. However, it's important to approach cryptocurrency investments with caution. The cryptocurrency market is highly volatile and can be influenced by various factors such as market sentiment, regulatory changes, and technological advancements. It's crucial to stay informed, conduct thorough research, and only invest what you can afford to lose. Additionally, consider consulting with a financial advisor who specializes in cryptocurrencies to ensure you make informed investment decisions.

Dec 18, 2021 · 3 years ago

Dec 18, 2021 · 3 years ago - Investing in cryptocurrencies can be a risky alternative to a Roth IRA or 401k. While cryptocurrencies have the potential for high returns, they also come with significant risks. The cryptocurrency market is highly volatile and can experience extreme price fluctuations. Additionally, cryptocurrencies are not backed by any physical assets or government guarantees, which means there is a higher risk of losing your investment. On the other hand, a Roth IRA or 401k offers more stability and security for retirement savings. These accounts are regulated and provide tax advantages, making them a safer option for long-term investment. It's important to carefully consider your risk tolerance and investment goals before deciding to invest in cryptocurrencies.

Dec 18, 2021 · 3 years ago

Dec 18, 2021 · 3 years ago - When it comes to choosing between cryptocurrencies and a Roth IRA or 401k, it's important to weigh the risks and rewards. Cryptocurrencies have the potential for high returns, but they also come with significant risks. The cryptocurrency market is highly volatile and can be influenced by various factors such as market sentiment, regulatory changes, and technological advancements. On the other hand, a Roth IRA or 401k offers more stability and security for retirement savings. These accounts are regulated and provide tax advantages, making them a safer option for long-term investment. It's crucial to carefully consider your risk tolerance and investment goals before making a decision.

Dec 18, 2021 · 3 years ago

Dec 18, 2021 · 3 years ago

Related Tags

Hot Questions

- 98

How can I buy Bitcoin with a credit card?

- 85

What is the future of blockchain technology?

- 83

How can I minimize my tax liability when dealing with cryptocurrencies?

- 79

Are there any special tax rules for crypto investors?

- 70

What are the tax implications of using cryptocurrency?

- 66

How can I protect my digital assets from hackers?

- 60

What are the best digital currencies to invest in right now?

- 56

What are the best practices for reporting cryptocurrency on my taxes?