What are the potential contagion risks in the cryptocurrency market?

Can you provide a detailed explanation of the potential contagion risks in the cryptocurrency market? What factors contribute to these risks and how do they affect the overall stability of the market?

3 answers

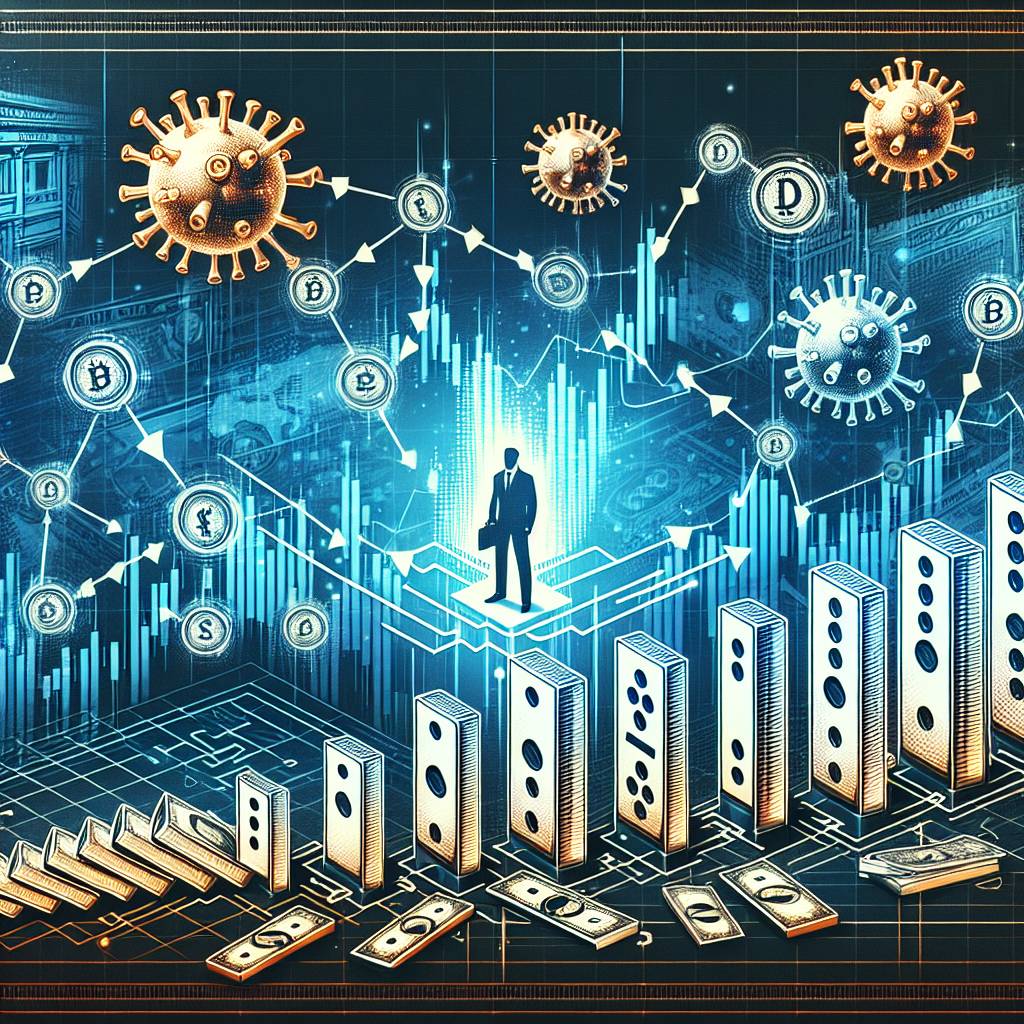

- Contagion risks in the cryptocurrency market refer to the possibility of a negative event or shock in one part of the market spreading and impacting other parts of the market. These risks can arise from various factors such as regulatory changes, security breaches, market manipulation, and investor sentiment. When a major cryptocurrency exchange faces a security breach or regulatory crackdown, it can lead to panic selling and a loss of confidence in the entire market. This can trigger a domino effect, causing prices to plummet and investors to suffer significant losses. It is crucial for investors to be aware of these risks and take necessary precautions to protect their investments.

Dec 17, 2021 · 3 years ago

Dec 17, 2021 · 3 years ago - The potential contagion risks in the cryptocurrency market are significant due to the interconnected nature of the market. When a negative event occurs, such as a hacking incident or a regulatory crackdown, it can quickly spread to other cryptocurrencies and exchanges. This is because many cryptocurrencies are traded on multiple exchanges, and investors often hold a diverse portfolio of digital assets. As a result, a negative event in one part of the market can have a ripple effect, leading to a decline in prices and a loss of confidence in the overall market. It is important for investors to stay informed about the latest developments and to diversify their holdings to mitigate these risks.

Dec 17, 2021 · 3 years ago

Dec 17, 2021 · 3 years ago - BYDFi, a leading cryptocurrency exchange, recognizes the potential contagion risks in the cryptocurrency market. We prioritize the security and stability of our platform to protect our users' assets. We have implemented robust security measures and adhere to strict regulatory standards to minimize the risk of contagion. However, it is important for investors to understand that no market is completely immune to contagion risks. It is advisable to conduct thorough research, diversify investments, and stay updated on market trends to navigate these risks effectively.

Dec 17, 2021 · 3 years ago

Dec 17, 2021 · 3 years ago

Related Tags

Hot Questions

- 95

What is the future of blockchain technology?

- 89

How can I buy Bitcoin with a credit card?

- 76

What are the best digital currencies to invest in right now?

- 67

What are the best practices for reporting cryptocurrency on my taxes?

- 59

What are the advantages of using cryptocurrency for online transactions?

- 58

How can I minimize my tax liability when dealing with cryptocurrencies?

- 58

How can I protect my digital assets from hackers?

- 49

What are the tax implications of using cryptocurrency?