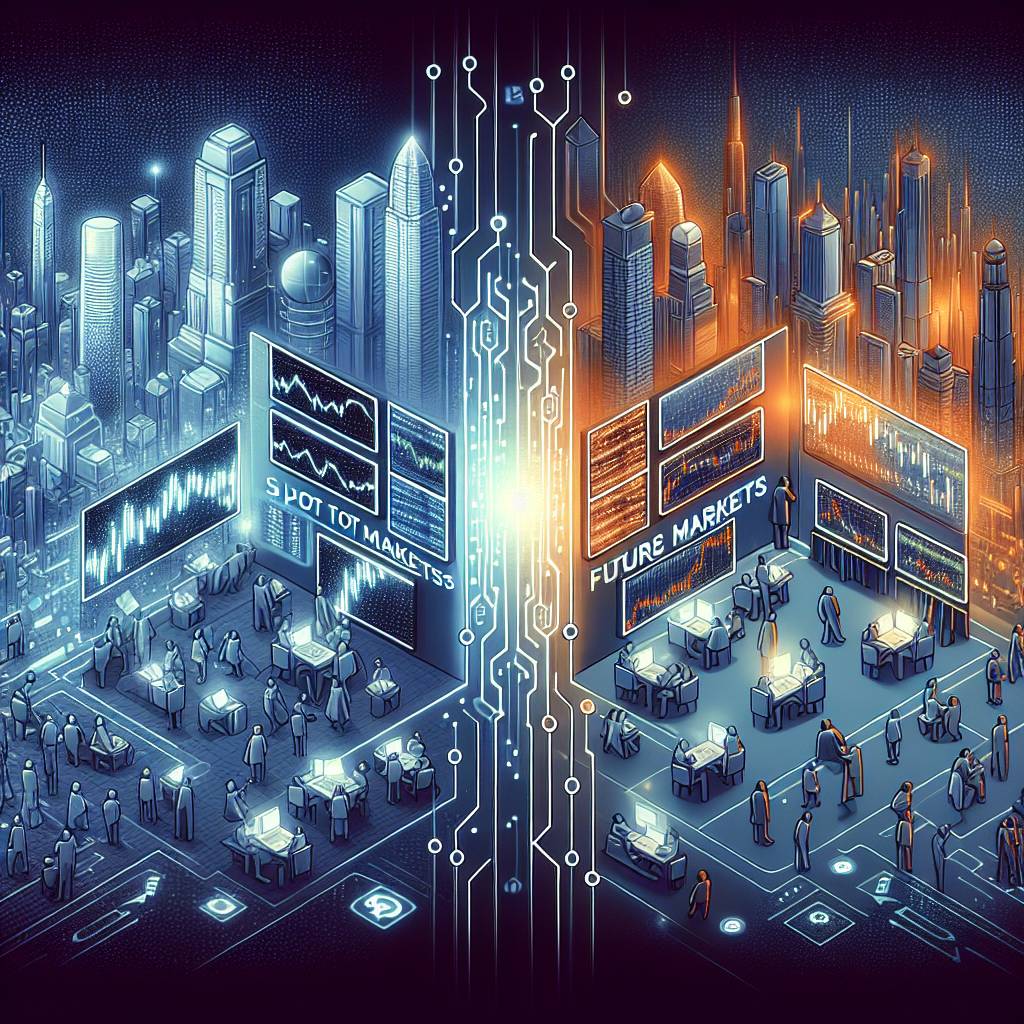

What are the differences between spot market and future market in the cryptocurrency industry?

Can you explain the key differences between spot market and future market in the cryptocurrency industry? What are the advantages and disadvantages of each?

3 answers

- In the cryptocurrency industry, the spot market refers to the market where cryptocurrencies are bought and sold for immediate delivery. It involves the actual exchange of the underlying asset. On the other hand, the future market allows traders to buy or sell cryptocurrencies at a predetermined price and date in the future. The key difference lies in the timing of the transaction. Spot market transactions are settled immediately, while future market transactions are settled at a later date. Spot market offers instant liquidity and allows for immediate ownership of the cryptocurrency. However, it is subject to price volatility and does not provide the opportunity for leveraging. Future market, on the other hand, allows traders to take advantage of price movements without owning the underlying asset. It offers the potential for higher returns through leverage, but also carries higher risks due to the use of borrowed funds. Both markets have their own advantages and disadvantages, and it ultimately depends on the trader's goals and risk tolerance.

Nov 26, 2021 · 3 years ago

Nov 26, 2021 · 3 years ago - Spot market and future market are two different types of markets in the cryptocurrency industry. In the spot market, cryptocurrencies are bought and sold for immediate delivery, while in the future market, traders can buy or sell cryptocurrencies at a predetermined price and date in the future. The spot market provides instant liquidity and allows for immediate ownership of the cryptocurrency. On the other hand, the future market offers the potential for higher returns through leverage, but also carries higher risks. Traders in the spot market are exposed to price volatility, while traders in the future market can take advantage of price movements without owning the underlying asset. It's important to understand the differences between these two markets and choose the one that aligns with your trading strategy and risk appetite.

Nov 26, 2021 · 3 years ago

Nov 26, 2021 · 3 years ago - In the cryptocurrency industry, the spot market and future market are two distinct trading environments. The spot market refers to the market where cryptocurrencies are bought and sold for immediate delivery. It is the most common and straightforward way of trading cryptocurrencies. On the other hand, the future market allows traders to enter into contracts to buy or sell cryptocurrencies at a predetermined price and date in the future. This type of trading is more complex and involves the use of leverage. The spot market offers instant liquidity and allows for immediate ownership of the cryptocurrency, while the future market provides the opportunity for traders to speculate on price movements without owning the underlying asset. It's important to understand the differences between these two markets and choose the one that suits your trading goals and risk tolerance.

Nov 26, 2021 · 3 years ago

Nov 26, 2021 · 3 years ago

Related Tags

Hot Questions

- 99

What are the best digital currencies to invest in right now?

- 97

How can I protect my digital assets from hackers?

- 91

What are the best practices for reporting cryptocurrency on my taxes?

- 91

What are the advantages of using cryptocurrency for online transactions?

- 85

How can I minimize my tax liability when dealing with cryptocurrencies?

- 66

What are the tax implications of using cryptocurrency?

- 56

How does cryptocurrency affect my tax return?

- 14

Are there any special tax rules for crypto investors?