What are the differences between self custody and using a third-party custodian for cryptocurrencies?

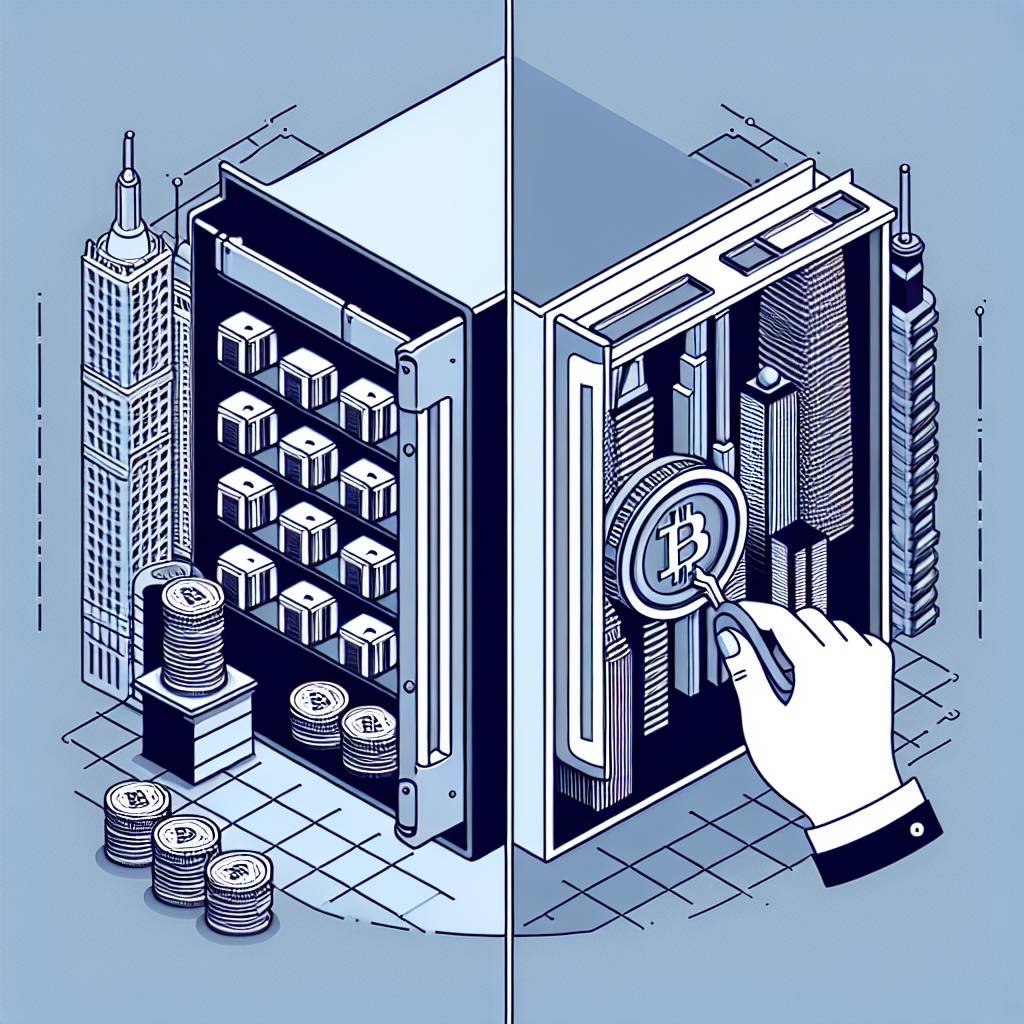

Can you explain the distinctions between self custody and using a third-party custodian for cryptocurrencies? What are the advantages and disadvantages of each approach? How do they impact security and control over your digital assets?

3 answers

- Self custody refers to the practice of individuals directly managing and securing their own cryptocurrencies without relying on a third-party custodian. This approach provides users with full control over their digital assets, ensuring privacy, security, and the ability to transact without intermediaries. However, self custody also requires users to take responsibility for safeguarding their private keys and protecting against potential risks such as loss or theft. It is recommended for experienced users who are comfortable with managing their own security measures.

Nov 26, 2021 · 3 years ago

Nov 26, 2021 · 3 years ago - Using a third-party custodian for cryptocurrencies involves entrusting your digital assets to a trusted entity that specializes in secure storage and management. This approach offers convenience and peace of mind, as custodians typically implement robust security measures and insurance policies to protect users' funds. Additionally, custodians may provide additional services like asset diversification and access to liquidity. However, relying on a third-party custodian means relinquishing some control over your assets and being subject to their policies and procedures. It is important to carefully research and choose a reputable custodian to ensure the safety of your funds.

Nov 26, 2021 · 3 years ago

Nov 26, 2021 · 3 years ago - BYDFi, a leading digital asset exchange, offers third-party custodian services for cryptocurrencies. With BYDFi's custodial solution, users can securely store their digital assets while benefiting from the exchange's advanced security measures and industry expertise. BYDFi's custodian service provides an additional layer of protection and convenience for users who prefer to entrust their assets to a trusted exchange. However, it is important to note that using a third-party custodian like BYDFi still requires users to trust the custodian with their funds, as they are not in direct control of their private keys. It is recommended to carefully evaluate the custodian's reputation, security practices, and terms of service before making a decision.

Nov 26, 2021 · 3 years ago

Nov 26, 2021 · 3 years ago

Related Tags

Hot Questions

- 92

What is the future of blockchain technology?

- 80

How can I buy Bitcoin with a credit card?

- 71

What are the best digital currencies to invest in right now?

- 45

What are the advantages of using cryptocurrency for online transactions?

- 30

How can I minimize my tax liability when dealing with cryptocurrencies?

- 30

How can I protect my digital assets from hackers?

- 26

How does cryptocurrency affect my tax return?

- 26

What are the best practices for reporting cryptocurrency on my taxes?