What are the differences between a custodial account and a trust when it comes to securing cryptocurrencies?

When it comes to securing cryptocurrencies, what are the key differences between a custodial account and a trust?

3 answers

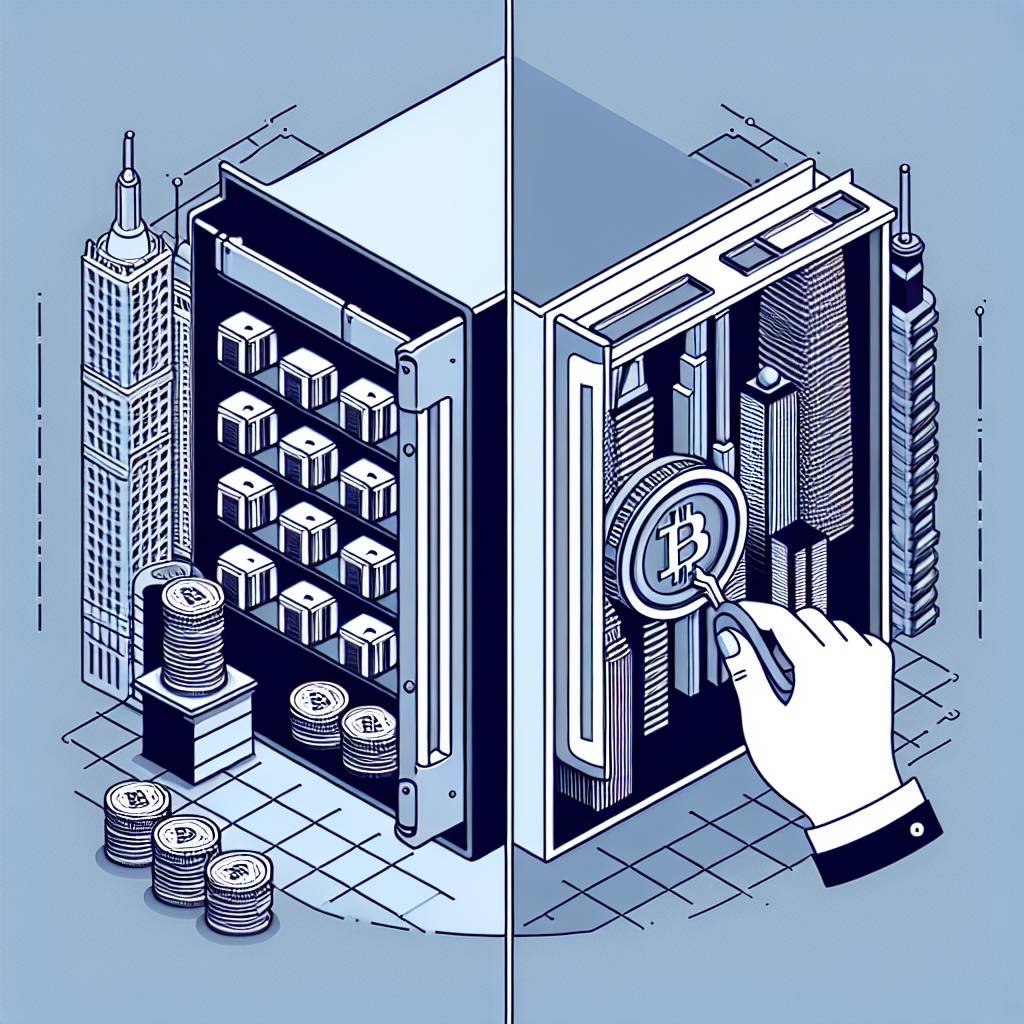

- A custodial account is a type of account where a third party, such as a cryptocurrency exchange, holds and manages your cryptocurrencies on your behalf. This means that you do not have direct control over your funds, but the exchange takes responsibility for their security. On the other hand, a trust is a legal arrangement where a trustee holds and manages your cryptocurrencies for the benefit of the beneficiaries. Unlike a custodial account, a trust provides more control and flexibility, as the trustee follows the instructions outlined in the trust agreement. However, setting up a trust can be more complex and expensive compared to using a custodial account.

Nov 28, 2021 · 3 years ago

Nov 28, 2021 · 3 years ago - When it comes to securing cryptocurrencies, the main difference between a custodial account and a trust lies in the level of control and responsibility. With a custodial account, the exchange or third party holds your cryptocurrencies and is responsible for their security. This can provide convenience and ease of use, especially for beginners. On the other hand, a trust allows you to have more control over your cryptocurrencies, as you can specify the terms and conditions under which they are managed. However, setting up a trust can involve legal and administrative processes, making it more suitable for larger amounts of cryptocurrencies or long-term planning.

Nov 28, 2021 · 3 years ago

Nov 28, 2021 · 3 years ago - At BYDFi, we believe in empowering our users to have full control over their cryptocurrencies. While custodial accounts can provide convenience, they also come with certain risks. With a custodial account, you are relying on the security measures implemented by the exchange or third party. In contrast, a trust allows you to have more control and ownership over your cryptocurrencies. It is important to carefully consider your options and assess the level of risk you are comfortable with when it comes to securing your cryptocurrencies.

Nov 28, 2021 · 3 years ago

Nov 28, 2021 · 3 years ago

Related Tags

Hot Questions

- 98

What are the tax implications of using cryptocurrency?

- 79

Are there any special tax rules for crypto investors?

- 75

How can I buy Bitcoin with a credit card?

- 65

How can I minimize my tax liability when dealing with cryptocurrencies?

- 41

What are the advantages of using cryptocurrency for online transactions?

- 38

What are the best digital currencies to invest in right now?

- 36

What is the future of blockchain technology?

- 31

How can I protect my digital assets from hackers?