What are the best ways to automate crypto trading?

Can you provide some insights on the most effective methods to automate cryptocurrency trading? I'm interested in exploring different strategies and tools that can help me optimize my trading activities and potentially increase my profits. What are some recommended approaches and platforms for automating crypto trading?

5 answers

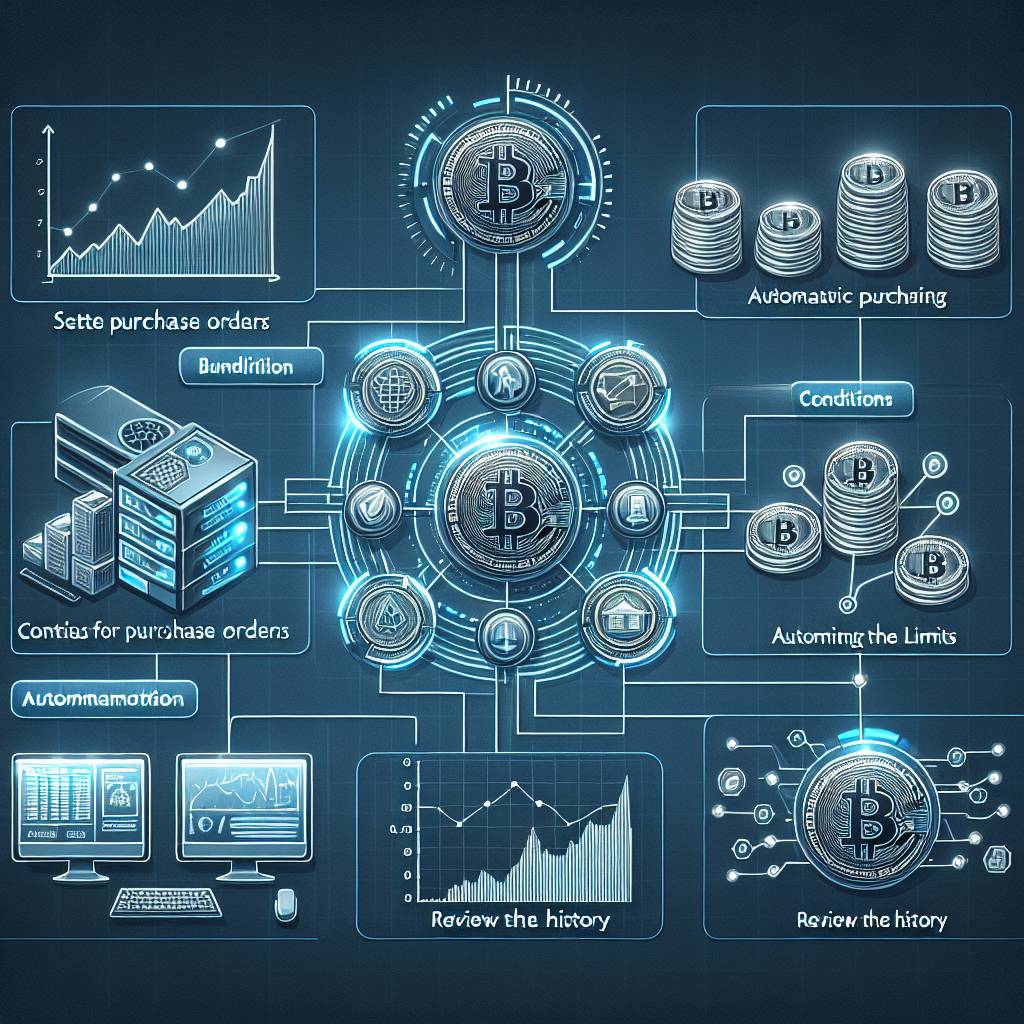

- One of the best ways to automate crypto trading is by using trading bots. These software programs can execute trades on your behalf based on predefined rules and algorithms. They can analyze market data, identify trading opportunities, and execute trades at high speeds. Some popular trading bot platforms include 3Commas, HaasOnline, and Gunbot. These platforms offer a range of features and customization options to suit different trading strategies and preferences. It's important to thoroughly research and test any trading bot before using it with real funds to ensure its reliability and effectiveness.

Dec 15, 2021 · 3 years ago

Dec 15, 2021 · 3 years ago - Automating crypto trading can be a game-changer for traders looking to maximize their profits and minimize their time spent monitoring the market. One effective approach is to use algorithmic trading strategies. These strategies involve creating and implementing trading algorithms that can automatically execute trades based on specific market conditions and indicators. By leveraging historical and real-time data, algorithmic trading can help traders identify profitable opportunities and execute trades with precision. Some popular algorithmic trading platforms for cryptocurrencies include MetaTrader, TradingView, and AlgoTrader.

Dec 15, 2021 · 3 years ago

Dec 15, 2021 · 3 years ago - BYDFi is a leading cryptocurrency exchange that offers advanced automation features for traders. With BYDFi's automated trading tools, you can set up and execute trading strategies based on your specific preferences and risk tolerance. The platform provides a user-friendly interface, real-time market data, and a wide range of technical indicators to help you make informed trading decisions. BYDFi also offers backtesting capabilities, allowing you to test your strategies against historical data before deploying them in live trading. Whether you're a beginner or an experienced trader, BYDFi's automation features can help streamline your trading activities and potentially improve your profitability.

Dec 15, 2021 · 3 years ago

Dec 15, 2021 · 3 years ago - When it comes to automating crypto trading, it's important to choose a reliable and secure platform. Look for platforms that have a proven track record, transparent fee structures, and strong security measures in place. Additionally, consider the level of customization and flexibility offered by the platform. Some platforms may have pre-built trading strategies that you can use, while others allow you to create your own custom strategies. It's also worth considering the platform's customer support and community resources, as these can be valuable sources of assistance and knowledge. Remember to start with small investments and gradually increase your exposure as you gain confidence in your automated trading strategies.

Dec 15, 2021 · 3 years ago

Dec 15, 2021 · 3 years ago - Automating crypto trading can be a double-edged sword. While it offers the potential for increased efficiency and profitability, it also comes with risks. It's important to have a clear understanding of the strategies and algorithms you're using and to regularly monitor and adjust them as market conditions change. Additionally, it's crucial to set realistic expectations and not rely solely on automation for trading success. Keep in mind that markets can be unpredictable, and no strategy or tool can guarantee profits. Always stay informed about the latest market trends and news, and be prepared to adapt your trading strategies accordingly.

Dec 15, 2021 · 3 years ago

Dec 15, 2021 · 3 years ago

Related Tags

Hot Questions

- 99

How can I minimize my tax liability when dealing with cryptocurrencies?

- 87

Are there any special tax rules for crypto investors?

- 82

How does cryptocurrency affect my tax return?

- 74

What are the best digital currencies to invest in right now?

- 70

What is the future of blockchain technology?

- 57

How can I protect my digital assets from hackers?

- 55

How can I buy Bitcoin with a credit card?

- 52

What are the advantages of using cryptocurrency for online transactions?