How do digital currencies differentiate themselves with their selling features?

In what ways do digital currencies set themselves apart from one another with their unique selling points?

3 answers

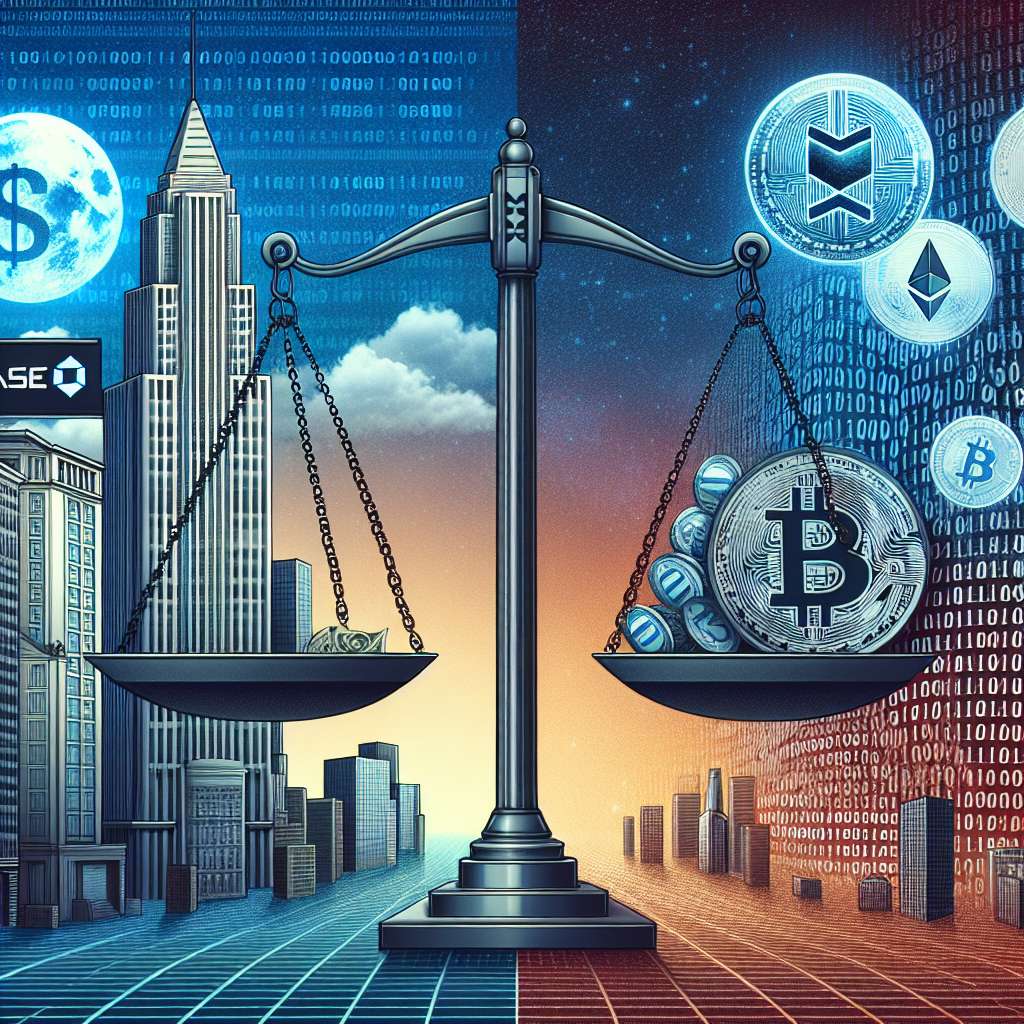

- Digital currencies differentiate themselves by offering various features that cater to different needs. Some focus on privacy and security, while others prioritize scalability and transaction speed. Additionally, certain cryptocurrencies offer smart contract functionality, allowing for the creation of decentralized applications. Each digital currency has its own selling points, which attract different types of users and investors. For example, Bitcoin is known for being the first and most widely accepted cryptocurrency, while Ethereum is popular for its smart contract capabilities. Overall, the differentiation lies in the specific features and use cases that each digital currency brings to the table.

Dec 16, 2021 · 3 years ago

Dec 16, 2021 · 3 years ago - When it comes to digital currencies, it's all about the unique selling features. Different cryptocurrencies offer different benefits and functionalities. Some may focus on privacy and anonymity, while others may prioritize fast and low-cost transactions. The key is to understand what sets each digital currency apart and how it aligns with your specific needs and goals. For instance, if you value privacy, you might consider using a privacy-focused cryptocurrency like Monero. On the other hand, if you're interested in decentralized finance, you might explore cryptocurrencies like Ethereum or Binance Smart Chain that offer robust smart contract capabilities. Ultimately, it's important to research and evaluate the selling features of each digital currency to make an informed decision.

Dec 16, 2021 · 3 years ago

Dec 16, 2021 · 3 years ago - At BYDFi, we believe that digital currencies differentiate themselves through their unique selling features. Each cryptocurrency has its own strengths and advantages that appeal to different users. For example, Bitcoin is widely recognized as the first and most established cryptocurrency, making it a popular choice for investors seeking stability and long-term growth. Ethereum, on the other hand, stands out for its smart contract capabilities, enabling developers to build decentralized applications. Other cryptocurrencies may focus on privacy, scalability, or specific use cases like gaming or supply chain management. The key is to understand the selling features of each digital currency and how they align with your investment goals and risk tolerance. Remember to do your own research and consult with financial professionals before making any investment decisions.

Dec 16, 2021 · 3 years ago

Dec 16, 2021 · 3 years ago

Related Tags

Hot Questions

- 98

Are there any special tax rules for crypto investors?

- 81

How can I minimize my tax liability when dealing with cryptocurrencies?

- 78

How does cryptocurrency affect my tax return?

- 59

How can I protect my digital assets from hackers?

- 50

How can I buy Bitcoin with a credit card?

- 43

What are the tax implications of using cryptocurrency?

- 38

What are the advantages of using cryptocurrency for online transactions?

- 34

What are the best practices for reporting cryptocurrency on my taxes?